For two years, US stocks went straight. In a weekly subject, it becomes upside down, and the number of equity is discontinued when the volume of the equities is intense.

The article content

(Bloomberg) – US shares went against the effect for two years. In a weekly subject, it becomes upside down, and the number of equity is discontinued when the volume of the equities is intense.

The article content

The article content

Tech-Heavy Nasdaq has fallen 3 per cent on Monday, and now, 2022, the worst of its worst. S & P 500 index submerges 2% index to the edit since its February. The index ends below the average of the 30-day average since November 202. Several nine sessions fell by 5% from February 2020, because the pandemic was starting to stay in.

Advertising 2

The article content

President Donald Trump warns that Americans see the benefits from tariff struggles. He refused to deny the possibility of the recession.

Stratetors and economists in Wallstreet are also adversely raising for US recession. The US stock markets the US stock market to be a group of turbulence.

The economic improvement group of the financial improvement group and Technicalist, Portfolio Manager, Technical Analyst, Portfolio Manager. “If the Back-to-Back-back is closed, it will signal in a shift in the S & P 500.”

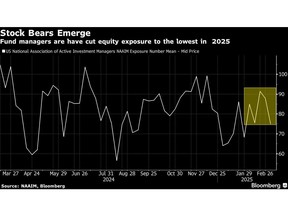

Of course, feeling that the bad will get this bad, and it is a thought that resists the bad. More losses cut to the equity positioning bone in equal expectations. When stocks fall, the bulls were forced to the cave. In first, the equity positioning is a little light for the first time after the trade ratter market is unwined. It seems to argue that the support purchase is possible before the length.

The article content

Advertising 3

The article content

Yet the calculus is not simple. Investors The underlines are underlined as a few months ago, the hopes of fluctuating the geopolic risk, rising and higher inflation. As the business of the trade in 2018-2019, the S & P 500 may be pulled up to 8% to the bottom of its historical sequence. There is currently a marketing by 5,650.

In the light of the federal government’s trade and economic policies, Andrew Tyler warns the GPEMORGAN CHESS and the company and the head of Gopmorgan in the Consense Andrew Tyler is unwise.

“We think a comeback is less suddenly less than the” Tyler Monday. “When the more tariffs in the market, we do not believe the more tariffs are available in the market.

Hedge funds aggressively, the lowest stock ratio since 2019 has ended the lowest stock ratio since 2019. Morgan Stanley’s Michael Wilson’s economic growth concerns.

Advertising 4

The article content

Sales and side institutions are in touch with US shares. Monday, HSBC Holdings PLC degraded the US to the UACs the US. Tim Heg Heaes, who was properly called the current bull full of global stocks, and overloaded the Chief Global Investment Strategy to the Babose.

Terms, while the terms of over-digits, the 13-day relative power index of the S & P 500 is still more room above 30.

The size of the CBO is a liking index, or the size of the price of the vix, S & P 500 is closed on top of a fifth straight session. According to the Bloomberg compiled figures. A level of 20 usually puts pressure on the stock market.

The need to haunt the options in an increasing wicket, is associated with the relative to the intense turbulence. Meanwhile, the most dangerous pockets in the market fell 1.9% in the market, such as the small capitalization rizel 2000 index.

This is because the first bounce is historically encouraged the first bounce to have a market and market. We’re not there yet.

We are not sure about a sustainability of an relief rally that may be for the S & file, because the small caps are still published, “Wald is said in a phone interview.”

The article content