Bond merchants indicate that the US economy is threatened to dissolve the growth speed of the growth and the federal-workforce.

The article content

.

The article content

The article content

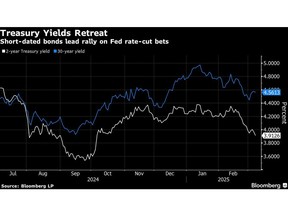

Trump will stimulate the extension of the country – maintain the treasury yield rapidly of the treasury yield and rapidly affects less than two months. Instead, the traders will reduce the interest rate to increase the economy from mid-February and the limit to two years.

Advertising 2

The article content

We get questions a few weeks before we think the economy will accelerate again, now indicates the risk of a recession. “The growth of the growth of the market growth.”

The dominant driver was overwhelmed by the dominant driver in the last few years, as the dominant driver weakened abroad abroad. In the beginning, investors have hurt that this trend and driven driven by the trend of the tendency and driving.

Since the mid-February and the policies of the new regime, the treasury yield has declined as an uncertainty of the new regime. Investors occurs when investors can lighten the financial tactic for investors to lighten the monetary policy of growth.

The article content

Advertising 3

The article content

There is a trumeter trade trade for a major driver trump, and it will perform another inflation and global distribution chains. A stock-market cell is increased even after the tariffs were delayed in Mexico and Canada. Federal funding also takes a toll of the administration of the administration of their thousands of government workers.

Due to the order of the Trump’s policies, the recession is definitely high – Tarif later, tax cuts, “Bendwein a portfolio manager of the Global Investment Manager Tracy Chen.

Values of Bond Markets vary in Europe and the US, evacuated this week and imposed the week. But when German bond yields increased, the US pinback of the US barely barely to support Ukraine.

Of course, Bond merchants have been prepared to repeat the economy over the past few years, and reduce three quarter-point fares. Powell said that he was in a good place to say, “There is an uncertainty in a good position, despite the absolute degree of uncertainty.”

Advertising 4

The article content

Moreover, the employment index demands increasing inflation in February in February, the Consumer Price Index this week will be reported in February.

But the indications of the economy are gradually decreasing, including the Atlanta Fed’s GDPNO gauge, which is set to shrink in the first quarter.

When the Labor Department reported softening of employment in February, the labor market was softening and a jump for working reasons for financial reasons.

Bloomberg Stratesets …

“The details of the report seem to be worse than headlines, the forward sides of the report increases to continue hospitals.

Advertising 5

The article content

-Edward Harrison, Bloomberg MLV Strategist. More than mliv.

The way of the bond market will depend on how to form trump’s policies in the next few months. Treasury Secretary Scoot Bursent approved the economy due to policies of the governing body policies, but expressed confidence in a long-standing point of view.

Trump was responding to a “hatpat secretaries’ in employment. The rates of Mexico and Canada were delayed as a month in increased monthly as a month increases a month.

“Before this tariff war, market thought tariffs were inflation, now people think that they are recession,” said Brandwin’s Chen. “So it’s a big shifty.”

What to see

- Financial data:

- March 10: 1 year inflation expectations

- March 11: NFIB Small business optimistic; Jolse the employings of January

- March 12: MBA Mortgage Applications; Consumer Price Index; The original average hour and weekly income; Federal Budget Balance

- March 13: Price index for manufacturer; Initial and continuing claims; The change of domestic change

- March 14: Michigan consumer feeling of feeling and inflation of hopes

- Feeding Calendar:

- March 18/19 Policy Blackout monitoring the Blackout ahead of policy meeting

- Auction Calendar:

- March 10: 13, 26 weeks bills;

- March 11: 6 weeks bills; Three years of notes

- March 12: 17 weeks bills; 10 years of notes

- March 13: 4-, 8 weeks bills; 30 years of bonds

The article content