[ad_1]

The President of the Chinese Xi jinping Met with leading private sector entrepreneurs on February 17, including the founder of Alibaba Jack toAfter many years of regulatory repression, Beijing identifies the change in the approach towards the technology sector. This move comes as China is facing economic challenges, reducing business confidence and technical competition with the US

Why is it important

- This meeting is widely attempted to promote business leaders and investors, which China is committed to supporting private companies after heavy interventions for many years.

- Regulatory prevention of the technology sector, which began in 2020, cleared the trillion from the value of the Chinese stock, preventing innovations, and leading to a top entrepreneurs like MA from public view.

- Because of the difficulty of recovering from the infection, Beijing needs to maintain a private sector and maintain technical competitiveness than now.

Background

The Communist Party of China has a long history of cleansing and later rehabilitation of the influence. Deng Xiaoping was purified three times before leading China from Maoism. Today, a similar process seems to be playing for business leaders.

The fall of Jack Maui began in 2020 with general criticism of China’s financial regulators. The government responded by blocking the IPO of the Ant Group, launching an investigation in Alibaba and imposed on registration. Ma disappeared from public view for many years.

The reappearing with XI refers to a strategic change because the government is trying to create a balance between regulatory and economic revival.

By numbers

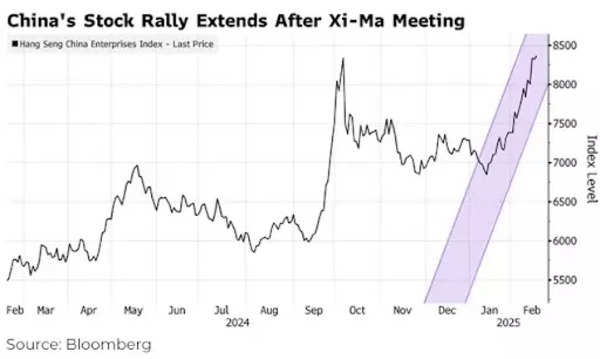

- On February 14, Alibaba’s share rose 6.2% -it added to its market value to $ 18 billion -rumors that Shi met with trading leaders.

- Tensent and Siomi saw 7%share gains.

- Hang Cheng Technology Schedule, which monitors China’s largest technology companies, increased by 23% last month, and Alibaba stocks have more than 50%.

What is the running of the shift

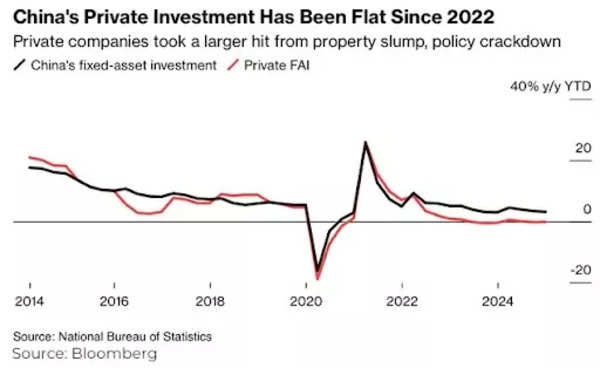

- Economic Need: Beijing’s repression on technology companies destroyed about $ 2 trillion from China’s stock exchanges. The government now needs a private sector to help ensure the economy, with the hope of dull growth and low investors.

- AI and Technical Innovation:

Deepseek A Chinese AI company was able to remain with the Silicon Valley, despite the US chip restrictions. Investors see AI a new growth drive and see Alibaba’s 2014 IPO. - Global Competition: The US has increased efforts to cut China from major technologies, including semiconductors. To compete, China must rely on private sector innovations, especially AI and Cloud Computing.

- “Technical Competition with the US is an indirect consent that private sector corporations need private sector companies,” said Christopher Fedor Reuters, Deputy Chinese research director of Contcal Dragonomics in Hong Kong. “If you want to compete with the United States, the government has no choice but to support them.”

The big picture

- Over the past few years, China’s regulatory repression has sent a clear message in technology companies: the government is under control. These oppression targeted monopoly procedures, financial risks and data protection concerns.

- Following the repression of Alibaba and ant group, strict regulations of private training, gaming and online credit have caused widespread investors’ uncertainty.

- China’s economy, including the need for a dull property market and weak consumers, continues to face headaches, and it is a preference to change the sense of the private sector.

Between the lines

XI’s meeting policy assured the entrepreneur of stability, but questions are about the extent of real regulatory relaxation.

Although the Beijing acknowledges the importance of the private sector, control is very important. Technology companies are still expected to comply with state priorities, especially AI and Internet security.

Despite the positive signals of the crowd, China’s business faith is brittle. Entrepreneurs prefer more than rhetoric; They need concrete policy changes, such as easy IPO approval and sober financial controls.

What do they say

Researchers see this meeting as a significant change in China’s approach to the private sector, but they are cautious about the long -term impacts.

The renewed enthusiasm for China’s technical companies is often based on the false example of a revival in AI’s progress in AI. We do not agree that the revenue vision in most companies is often unchanged. Increasing economic uncertainty, the risk of increasing tensions with the United States, creates an uncertainty sector outlook by 2025

Researchers at Bloomberg Robert Lia and Jasmine Liu

According to the Reuters report, some expert comments at the meeting are here:

86 In Search, Shanghai -based analyst Charlie Sai: “We hope that this phenomenon will be followed by pro -technical principles. The possible moves include the focus of ‘national security risks and social outdoors’ to the higher risk of technical use.

“(It) includes the mass sequence of AI creation, autonomous driving and human robotics.

“Similarly, bond regulators are more likely to adopt the most accommodation, allowing technical companies to finance more access to capital markets, which will help resolve the uncertainty of uncertainty (eg, tithi, ant, tehu).”

Alfredo Montoofer-Heluu, Chairman of the China Center of the Chairman of the Think Tank: “President XI led the symbol, which refers to the recognition of the Chinese top party leadership as a significant role in the support of the development of China’s private companies, and most importantly, in recognition of China’s technical aspirations in the face of emerging Western restrictions.

“We should expect more support for the private sector, especially in the country of strategic importance.

“Despite their shortcomings, Deepseek is now, and before that, Huawei Grin Chip sends a strong message to the West: no matter how expensive China is, it has the purpose and resources to innovate the way out of technical restrictions.”

Fred Hu, Founder and Chairman, Primavera Capital Group, Hong Kong: “President Shi’s meeting with Chinese private entrepreneurs is clearly referred to a great course amendment.

“The private sector, the spine of the Chinese economy and the most important development machine, have been on the rise in recent years, with the uncertainty and regulatory uncertainty, serious consequences for China’s economy and the unemployment for its labor market.

“The well -promoted meeting of leadership with the country’s highest entrepreneurs like Jack Ma could not come at a very important stage.

“This should help the entrepreneur and raise the confidence of the business and investors on China.”

Tom Nunlist, Joint Director of Policy Research Advisory Trivium China: “Technical repression has been firm for some time, and the government has been trying to create more confidence in the private sector and technology sector.

“There is some continuous suspicion because at the end of the day, G Jinping’s concept is very important. You cannot do better than G Jinping personally approve.

“I think it took so long to hold this meeting because the G changes the course.”

Chiayan Zhang, Finance Professor, Singua University, Beijing: “The purpose of the meeting understands the private sector, to ensure that they are the most important part of the economy for the development of stability and economy.

“We want to support you, novelty, you need to increase technical innovations, and you need to increase consumption.”

Gary NG, Senior Economist of Nadcis, Hong Kong: “In spite of the increasing chances of the Deepseek, it is at risk of guiding the private sector in the state -led direction and competing with the United States.

“The market reads this as a positive signal to add Jack MA in such a meeting and believe in the end of technical repression. However, the regulatory environment is black box.

“Since most AI growth is taking place in the private sector, we cannot completely reject the end of the regulatory environment expected to be tight than the market.”

What

- Annual Legislative Leading in March: Authorities are expected to issue an economic map for 2025, with possible measures to support private companies.

- IPO Terms: Beijing’s position on foreign lists is uncertain, and reports of companies like Sheen go to opaque regulatory processes.

- AI Development: China’s AI and advanced computing will be an important indicator of how much private companies get in designing the country’s technical future.

Will this change last?

- Suspects argue that when Shii’s meeting is signaling a change, it is not necessary for the uncontrolled boom of the past to return.

- Government control over the technology sector is strong. Beijing still forcing strict compliance with its regulations, ensuring that technology companies prioritize national interests above the purposes of profit.

- The concept of “common prosperity” is an important preference, which is expected to contribute to technical institutions social and economic projects.

- Entrepreneurs must now play according to the party’s rules – or face deportation. While XI’s latest overlays increase investors’ feelings, they have not done slightly to destroy the regulation of repression for many years. Business leaders may be allowed back into the lap, but they are alert to the Communist Party.

(With inputs of agencies)

[ad_2]

Source link