The widespread liquid -made natural gas terminal on the beautiful southern coast of India is proof of the efforts of the country’s efforts to control its coal drugs – and its limited success.

Article content

.

Article content

Article content

The widespread liquid -made natural gas terminal on the beautiful southern coast of India is proof of the efforts of the country’s efforts to control its coal drugs – and its limited success.

Advertisement 2

Article content

Use from opening a decade ago, Petronet LNG Limited Kochi facility is all silent. Last year, it operated a quarter of its purposeful capability, and the lack of pipes to send fuel to cities and industrial centers in the region. This is the story that repeats itself in the world with a population of the world.

India’s infrastructure disorders are a list of long and complex reasons for the uncertainty of uncertainty to prevent investors, from local residents to opposition, high gas prices and unfavorable tax regime. Everyone has been affected by Prime Minister Narendra Modi’s wishes for the embrace of gas – and has threatened the ambitious projects drawn by producers like Shell PLC and Total Innergees SE, which has invested billions of dollars in new gas supply.

“There are some big spaces on the pipeline network and we need to insert them,” Anil Kumar Jain, chairman of the Petroleum and Natural Gas Regulatory Board, told the New Delhi Conference on India’s gas opportunities last month. A regulatory team is working on policies to make Pipeline investments more profitable.

Article content

Advertisement 3

Article content

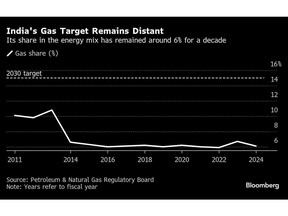

India is more than twice as much as the share of gas in its energy mixture in 2030, but for about a decade of share of the share of that position, it is the first time in India’s Energy Week in Delhi from Tuesday to the agenda for the participants who have collected a headache.

The new Delhi -based Thinking Group, the Observer Research Trust, said the consumption of gas consumption should rise to 600 million cubic meters a day to hit the target. This will require $ 67 billion investment for new pipes to import terminals and last miles.

“This is a thing we think – can India go from 6% to 15%? Can we help us reduce our emission and march towards net zero?”

India currently uses half of the gas pipeline network nearly 23,573 kilometers. However, even that gross capacity can carry only about 60% of the constituencies needed to hit its gas consumption target by the end of the decade, and Gajendra Singh, a member of the Petroleum and Natural Gas Regulatory Board, said this.

Advertisement 4

Article content

Many pipes are idle due to lack of last mile connection. In about 300 retail gas distribution areas, which have been auctioned for companies, about a quarter of a quarter of the domestic fields or imported terminals are not connected to the national stem lines, which will reduce the demand for fuel.

All of this is struggling with terminals built to obtain incoming exports. Only one of the LNG import facilities in India operates with full potential – Dahage in the western state of Gujarat. According to Bloombergnef data, the other six plants online all over the year ran at an average rate of only 29%. The global number is near 40%.

Pipe dreams

Gayle India Limited dominates the Gas Distribution and Transportation Infrastructure, which is often cited by developers and is accused of delay.

Accessing the land can be a major headache. A pipe connecting Gujarat and Punjab is now behind the schedule as it is now accessing the land. Deputy Petroleum Minister Suresh Gopi told lawmakers in December that developers have to negotiate with 4,150 landlords in 26 villages, just 69 kilometers away. The work began in 2011, but only one -fifth of the pipeline ended.

Advertisement 5

Article content

The regulators stopped a separate plan in Andhra Pradesh, Andhra Pradesh as the developer struggled with approval and land permits. According to government data, about 96% of the nine major gas pipeline projects in construction in September have missed their target date.

After many accidents in recent years, landlords have been somewhat retreated than safety fears. In June 2014, 21 people were killed and 18 injured in a fire at the Gayle Gas Plant in Andhra Pradesh. The accident spread to nearby houses, tea stalls and coconut trees in a perimeter of 50 meters. In 2023, a pipe bomb blast in Bangalore hurt at least three people.

India’s LNG industry will not be shifted quickly, and imports are still fighting to rise to a peak of 2020. Despite the nation as the fourth largest buyer in the world last year, imports for January fell 12% per year, and the spot prices made changes-such as oil products-even more attractive.

India’s focus on self-confidence prevents the government’s excitement of fuel, which may be brought from abroad-in the end of the need.

“India has significant sources of coal, which is very cheap. Now the renewal is very cheap. On the other hand, the high gas usage will be increased to the imported LNG,” said Manas Majumdar, who heads for oil and gas training in India. “When the use of gas increases, its stock will rise to about 10% by 2030. 15% of the target is always an aspiration. ”

With the help of Stephen Stopsinsky.

Article content