Halcion days of the corporate debt shows symptoms of dim, wet the wetters of the trade wars.

The article content

.

The article content

The article content

“Bank of America Corp Strategist Naha Khoda appeared to be a fracture that appeared in a fracture

It is fearful that the tariff is reduced the growth of the world economy, and policies are afraid to stagnant in the US. Although the most sparkled in six months last week, the most sparkled in six months, because they can become a slow downturn. Some hedge funds have already dropped as if investors are being poured into Hanan assets such as gold assets.

Advertising 2

The article content

“The surface of the surface, and the agglest levels rose too much,” A chance of opportunistic credit participation participation participation involved in the face of Bloomberg with Bloomberg TV Wednesday.

Here are five charts that highlight shipment sentencing in borrows:

Junk Risk Premiums

Increased Goldman Zachs Group Incorpor Group Incorpor Group Incorp-disposal premiums, it is ready to tolerate short-term pains for an attempt to resolve the trade deficit. In the third quarter, the third quarter of the third quarter they will now get high yield 440 base points in the third quarter. Before 295 Basis Point. Levels of March 13 were 335 basis point.

“Recently, we have changed from a market that used to buy and sell the facts and sell facts,” Bain Capital Credit Head Guout Ramondier said.

CDS Shift

Pergabres Investments Warning Pergabres Investments in Levil, which has occurred for the past 10 years, protecting only high yield of investment swaps protecting only the high yield of the past 10 years. Go ahead quickly, Mark Tit CDX North American Year Index dropped from August.

The article content

Advertising 3

The article content

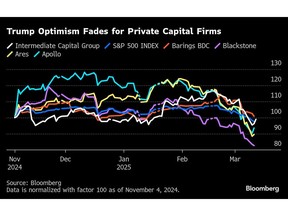

Private markets hit

The US economic policy is difficult for private capital institutions, and many people increase their portfolio companies in the private loan liners of it.

The risks of concerns about interest and their institutions in London in London, in a conference and their institutions in private equity-owned companies are a variety of interest in private equity-owned companies.

“Too many money flew to the asset asset class,” Connection capital Klair Madden Clair Madden Madhayan said. “We still don’t have a bicycle for a long time. There may be a lot of problems from the road.”

Drop the relevant loans

A plus issued in the relevant loan market compared to last year, the merits and acquisitions decline. Money managers now become more selective, aggressive pricing and credit for recent weeks.

Advertising 4

The article content

Credit of Flores

Contributing to the tightness of spreading is decreased as the recent arrives are usually expensive. But according to the US Levant Lons March 12, according to the March 12, according to the les lipper, investors pulled the high yield yield of high yield yields in two months. If investors turn to credit for equity market correctly, it may prove a blip.

Still, the head Goldorp said of the loan in BC participants. “It’s not good” because those funds become very large and market “very floss is based on the basis.”

Click here to listen to Credit Edge Podcast by Goldstore Goldorp

Week of review

- Credit markets were vulnerable in this week when the shares were sold while increasing trade wars. Bond sales are late in a series of many companies. Barclaces PLC to Goldman Zachs Inc.

- Global Banks appear to win corporate-bond trading business to achieve corporate-bond trading business.

- Investors are tightly tightly in the bats of European companies surveyed recurrently restructured in the European companies organized. Money managers are the tendency to “Dash for Trash”.

- Rio Tinto PLC sold US dollar deposit-grade bonds, raises funds to take up the lithium PLC’s just a lithium PLC.

- An investors in the loan package about the loan package about a loan package about the loan package of $ 4 billion dollar credit rope

- The Ardang Group holds a discussion with its debt to lose its debate to the Irish billioneshwar the packaging company of the packaging company.

- Banks led by UBS Group AG Has Dollars Dollar Dollar Dollars Dollars Wednesday.

- The lenders of lending or depositors of $ 1.3 billion lenders and widespread transmission provided with a contract broadcast service provider.

- Money managers support the US corporate loans not only imagining the US residential mortgage debt marketing. Collautorized Loan liabilities began to appear relatively relating to collaterior mortgage liabilities, which can help you pay future benefits.

- In the latest indication of the asset class, the Dutch Bank increases the size of a substantial risk transfer associated with a portfolio associated with a portfolio associated with a portfolio.

Advertising 5

The article content

In the move

- Bank of America Corp. The newly created role after issuing a high yield of high yield and a newly created role.

- JP Morgan Champion and Co-operatives, Banker Jai Harris from Bank of America Corporation. To cover more comprehensively than the largest loan and mid-moving companies in the wall street.

- The Canadian Imperial Bank Harry Comever won Chief Executive Officer Victor Dodig has been removed in a decade.

- HSBC Holdings PLC Alex hired Paul’s hired Paul and lead to the acquisition of its domestic merits. Paul will be the headquarters in Hong Kong, the new role will begin next month.

- As part of the emerging market credit, Bolder Zachs Goldman hires Bond Trade James Wilkinson from Sach.

- To control an alternative to the most profitable mercler Capital of the Millennium Management Esslar Capital.

- The CityGarght Incrotation was encouraged to the Services as pursuing the record of record income of 2024.

- The banksider SA has been selected as its new insurance to replace the Piries Commando Beckworo instead of replacing Armando Beckworo.

- Goldman Sachs Group Increase to increase investment banking business in Japan.

–

The article content