As the Irom Powell is firmly firmly to invest the economy, the economy continues to be ready to open the policy makeups.

The article content

.

The article content

The article content

As the Federal Reserve chair is rebuilt with the US Reserve chair, President Donald Trump’s rapid war rapid war rapidly increased. Bond yields will be reduced, customer feeling, economic concern for the economy.

Advertising 2

The article content

“Powell needs to be given a hint,” Dominiconic Konstam, the head of Maco Securities in the USA, said Dominiconiconicon. When the Fed chief, the officer is not aiming at the stock market, he warned that the Fed chief could not ignore the recent slide.

Federation expects permanent interest rates will be confirmed when visiting March 18-19, but this year, three-rates gains three-rates, and almost begins. Economics generally expects two less than less, and policy-component predictions to show the Wednesday.

Some investors keep the federal chief to protect the federal chief for the officials continue to be two shortcomings in 2025.

In margin, the feder may slightly improve or shorten it, “said the portfolio manager of the Marcaro Investment Management.” But they will not completely calm down the markets. ”

The article content

Advertising 3

The article content

On top of the respection of the biggest trade partners in the United States, the trump administration has not done more to redeem the recession risk. The President of the US economy is facing a “conversion period and his Treasurer Secretary Score Besser’s president said.

Market response

The two-year yield is most sensitive to the Fed’s cash policy and the half of the mid-January to 60 basis point and five-month low. Shares were on Friday, when the Shares of the S & P 500, remove the removal of 10% of the Plunch of the Plus. Wilstre’s fear of Wall Street, the Wilstre’s fear of Wall Street was rising to the highest level from August last week.

The market gitters in the market, which officials offered to expect trump’s policies, decreased. Hope their predictions will be a little bit of their predictions and increase their vision of major inflation and their viewpoint, which affects food and energy.

Advertising 4

The article content

The Powell is likely to implement that fedestrating in the course of the main context will be implemented.

“We will listen to the message that is still upholding things up and in an economy or economy,” a senior economist, “the two aspects of their Mardet’s two sides they are hanging. “

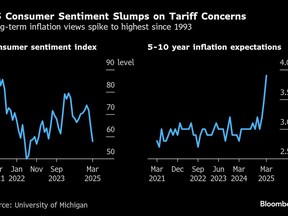

The production price index of the Price Index (s), which is earlier, the manufacturer’s price index in February. The concluded amount of long-term inflation expires rose higher decade from the third month.

Advertising 5

The article content

The US Economist Mathew Lucete, US economist, Mathew Luctee, said that they are limiting the fedd to introduce the fedest to introduce the economy until they appear directly in the work market. It can be shown in the form of weak pay achievements, increase the increase in the cost of unemployment or spike in award, he said.

“There is a lot of uncertainty there is possible to do filters to the hard data, but it is likely to see if it will happen or not. “At the same time, I think they see more evidence to do their work for inflation.”

If terrorists face a weak economy, two-thirts of the financial states said, “They are hoping that the cost of a Bloomberg survey is expected to expect cost in a Bloomberg survey.

Tax cuts and unconturbed trump administration is likely to increase the economy and unconturbed policies and inflation. Trup’s policies are “What is” setting the policy before adjusting the policy, the power and his colleagives are emphasized.

Advertising 6

The article content

“Although the US economy is in a good place, the US economy continues to be in a good place,” this month said first, the official said first before the week. “We don’t have to be busy and better place well to wait for more clarity.”

Balance Sheet

Wall Stratests will be hurt to temporarily or slow the funds to suspend or slow to stage the plans. Until the legislators have a contract for the leg-ceiling, the process of converting the legislators should be suspended or slowing down the process.

“The federal of March is already talking about this,” said Blaid Gwin in the USBC Capital Markets.

What to see

- Financial data:

- March 17: Empire construction; Retail sales; Business inventories; Nahib Housing Market Index

- March 18: Housing begins; Building permits; Import and export prices; New York Federal Services Business Activity; Industrial output; Capacity tools; Construction of manufacturing

- March 19: MBA mortgage applications; Net Long-Term, Gross FLOS

- March 20: Current Account; Claims without initial unemployment; The CPAII gave birth outlook; Long index The current home sales

- Feeding Calendar:

- March 21: New Yorkath President John Williams

- Auction Calendar:

- March 17; 13-, 26 weeks Bills

- March 18: 52 week bills; 6 weeks bills; 20 years Bond re-opening

- March 19: 17 weeks Bills

- March 20: 4-, 8 weeks bills; Re-opening 10 years tips

Christine Aquino, Nasul Ahsan, you with the help from Xie and Maria Eleza Caparo.

The article content