[ad_1]

Agreement relating to selling their shares Motivo Concluded C.C.C. Belonged with Zigmund Solarz Empoot 2, Rafaza Birzoski AR Investments and Investment Vehicles of Former Modio CEO Investment Vehicles

In total, these companies have 2.29 million shares and 22.81 percent. Motivo Capital. The majority – They have 10 percent – they have Zigmund Solors and Rafa Birzoski companies. In the spring of 2021, each of this package is BLN 500 million.

How many solars and Birzoska will be obtained for Motivo stocks

It was acknowledged Four merchants will receive approximately 1.36 billion to Modio’s qualities, and will be resolved by the contract reduction of additional PLN mutual claims. In turn, Solors and Birzoska will also get 2.5 million subscriptions in the new magazine of the CCC shares. Each of them can compensate for the BLN 20.

It has been several times lower than the current CCC rate since October last year. Stay in the range of PLN 170-220. At the end of the stock market session on Friday, the PLN was paid for the value of the company. The total value of the 2.5 million warranty is PLN 1.41 billion.

>>> PRACA.WIRTUALNMEDIA.PL – Thousands of media and marketing ads

Solors and Birzoska based on warrants can cover the new CCC shares until the end of June 2027. Through the final curriculum released by the Warsaw Stock Exchange, the 10 (ten) session of the new publication has increased by 50 %, after this value, the share of the company has increased by 50 %after this value) – the draft will be described in the draft resolutions.

After Both merchants can purchase the CCC qualities at the cost of the CCC in the future, ie below the texture forecast by 2027.

Thanks to this, the CCC team is said to have earned more thanks to this, thanks to this. – This mechanism allows you to determine the amount of cash sales prices for the most favorable Motivo stocks from the company’s view – added.

Darius Miak will pay PLN 0.5 billion in CCC stocks

CCC wants to get roughly $ 1.36 billion from its own new magazine. If the draft resolutions in Walil are larger for the values, it pointed out that an additional 1 million documents can reach investors.

CC Group plans to allocate funds from their sales to implement their strategy. In the markets simultaneously used in Europe.

Public meeting on warrants and shares emissions Appointed on March 17.

The new CCC qualities will be broadcast as part of share capital to accept the general meeting of shareholders and to obtain the approval of banks from the CCC Group. The company has been set up for six months from the date of accepting a release resolution or till September 30 this year. If the necessary approval is not obtained during this period, the contract with the companies of four businesses will be terminated.

For the new release of the values of the company’s employer and the main partner CCC Darius Miek. His ultro investment vehicle translated the company’s management into a new publication shares as investing 500 million.

– In addition, AR and Emboot 2 told the results of the results of the AR and Emboot 2 conditional profit delivery contract and the minimum income in the investment in the warrants. Based on the contract, Ultro will ensure that these companies get a standard income rate, while part of the assessments they include the right to demand the sale of Emboot 2I AR – a part of their assessments.

Currently, CCC’s capital has 68.87 million. Darius Miak has 33.41 per cent of shares. Capital and 39.14 percent are usually votes.

In the last 12 months, the CCC exchange rate has three times the rise. He returned to the 2019 position.

Motivo does not enter the stock market

For many years, the CCC team announced that Modi would appear on the Warsaw stock market. Last week, the project was withdrawn in a report with the initial results of the past quarter.

– Due to the modification of the business model of the Motivo Group – the need to change its functions towards the entire CCC group’s online business center and the strict functional coordination of all channels and the merger of the client base, We leave the announced plans before applying to allow the Motivo Team shares to trade in WSE. We are focusing on conducting this business towards the most profitable e-commerce site in Europe and its full coordination with the structures of the CCC Group-Wonderful Darius Miec.

When changing the role of Motivo under the CCC Group, it was added to the communications that “Modi’s general offer can lead to the scattering of the shareholders, and that in this context, it will be contrary to the acceptance direction of online channels. Group.”

Investment vehicles, besides Brezoski and Solarz in 2021, funded Motivo Softbank: He bought unsafe securities for 500 million BLN, with the desire to switch to stocks. – Under the IPO Motivo S.A. By taking into account the deficit of changing the duty due to stock bonds, the revision of the dutious duties assessment at the cost reduced its value. Reducing the value of responsibility at the end of the Q4’24 is PLN 336 million, and the net impact of this amendment in Q4’24 is PLN 291 million (the current value of responsibility is the PLN 575 million) – States in the CCC group.

As a result of this change, the CCC team’s net profit will increase the PLN 291 million in their quarter. – This amount does not take into account the assessment of automatically transferring stock to the stock via the Softbank, which is in the course of the update and is presented in a separate position balance note – which is noted.

Motivo sells less but improves profit

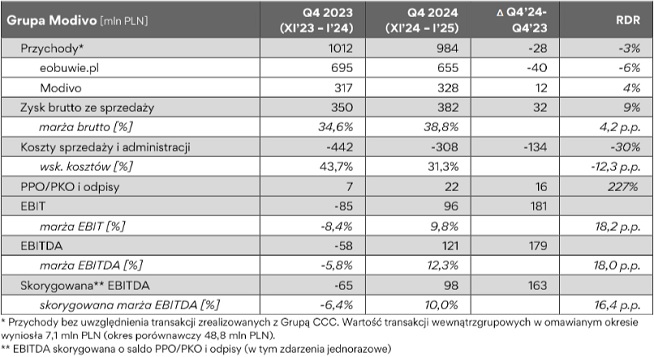

Income Motivo groups From November 2024 to January 2025, the Rotary quarter fell by 3 percent. Up to 984 million BLN 984 million, the EBUV network is 6 % decline in the PLN 655 million (the Motivo Sine Board 4 % increase is registered with PLN 328 million).

The CCC team explains this by withdrawing this from the lower lucrative markets .

While The Motivo team continued to strengthen profits in another quarter, as sales and administrative costs were reduced by 30 percent. The adjusted EPIDDA results in the PLN 65 million, the loss of up to 98 million, and the operational result – from the PLN 85 million, the loss of the PLN 96 million.

– After the Signs of CCC and Half Price are taken to a high level of profit, our activities are currently focusing on improving the results of the Motivo group. The effects of these works have been seen in the ankle strengthening online business gains over the past two quarters. We will show the full effects of the activated activities in subsequent periods – comments Darius Miyk.

[ad_2]

Source link